Next Hydrogen Canada to Raise Funds Through Share Sale for Technology Scale-Up

Canadian electrolyser manufacturer Next Hydrogen Solutions Inc. announced that its board of directors has approved plans for a common share offering aiming to raise CAD 30 million (USD 21.4 million / EUR 18.5 million) in gross proceeds.

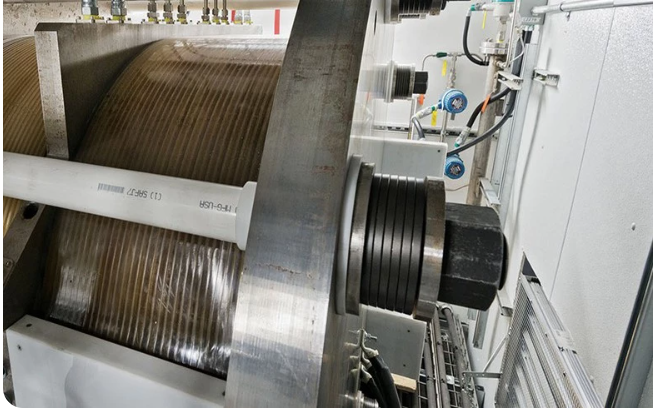

The non-brokered share sale, priced at CAD 0.45 per share, will provide capital to expand sales and manufacturing of the company’s NH150 electrolyser and to complete development of its larger NH500 model. A portion of the funds will also be allocated to working capital and general corporate purposes.

The offering seeks to secure a minimum of CAD 20 million and up to CAD 30 million, with completion expected around the end of November, pending all required regulatory approvals.

Next Hydrogen has already received subscription commitments exceeding CAD 20 million, primarily from Toronto-based Smoothwater Capital Corp, which is leading the transaction, along with participation from existing shareholders. Upon completion, Smoothwater is expected to become the largest shareholder in the company.

The financing will enable Next Hydrogen to transition from a development-focused enterprise to a commercially driven business.

“This transformative financing positions Next Hydrogen to reach cash-flow positivity,” said Raveel Afzaal. “We plan to focus on expanding product sales through a capital-light business model, leveraging our strong relationships with leading Canadian and global partners.”